PlayStation fans rejoice, because Sony has just released a new PlayStation Credit Card. Based on what we know about it so far, it seems like a solid credit card option on its own merits, and seems like an excellent option for PlayStation fans who already give a lot of money to Sony between games, PlayStation Plus, and any other Sony services. Read on to see the PlayStation Credit Card’s benefits and fees to see if it’s right for you. By the way, you can customize your credit card, so it doesn’t have to look like the above card.

Sony PlayStation VISA Credit Card Fees

The most important thing to note about any credit card is the fees involved. The best part about the PlayStation Credit Card is that there is no annual fee, meaning you can get this card just in case, and if you never use it you won’t be losing any money (though it may affect your credit score). The card is interest-free until March 2018, which as of now means about five full months of an interest-free period, and after that the APR will range from 14.99% to 24.99%, depending on your credit score. Five months isn’t the longest introductory interest-free period, but it’s better than nothing.

The APR can also be high (especially if you end up with the 24.99% APR), but is in line with most national credit cards (as opposed to a local credit union credit card). Also, if you just pay off your balance each month (so, if you spend the same amount of money that you would on a debit card), you don’t have to worry about this interest rate. In other words, this is not the best credit card available, but it’s also not unreasonable in any way, and seems like a great option for anyone who buys a lot of Sony/PlayStation products.

Sony PlayStation VISA Credit Card Benefits

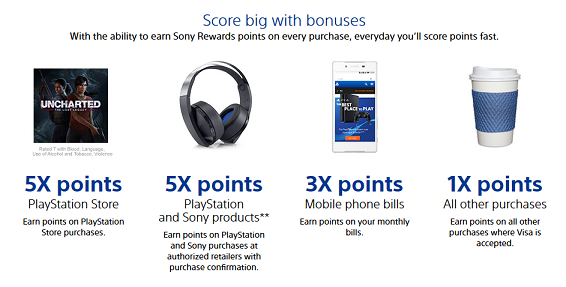

Now for the fun stuff. The PlayStation credit card offers 1X points on each purchase, so if you spend $5 you get back 5 points. These points can be used in Sony Rewards, and 100 points would be worth $1 in Sony Rewards. Of course, that’s not a great deal, but if you would have bought those PlayStation games anyways it’s just gravy. You earn 3X points on mobile phone bills, and 5X points on Sony/PlayStation products, as well as 5X points on anything in the PlayStation store. If you buy a Sony product from an authorized retailer that isn’t Sony (so, for example, if you buy a PS4 game at Best Buy), you automatically get 1X points and then need to fill out a form for the extra 4X, which is a bit of a letdown, but oh well.

There are a few other perks, too. The most exciting one is that you get a $50 PlayStation credit after your first purchase, which can buy you almost any PlayStation game in the store. That alone might make the card worth it for some people, especially PlayStation fans who don’t yet have a credit card and have been shopping around. You also get 10% off PlayStation Now, PlayStation Vue, and PlayStation Music. Finally, if you spend $3,000 in your first year with the card, you get a full 50% off of PlayStation Plus.

Is The Sony PlayStation VISA Credit Card Worth It?

At the end of the day, this is a pretty typical national credit card offer from Capital One. That can be a good thing, though, because it means that the card is not a scam or anything compared to other cards. For people who already buy a lot of Sony/PlayStation stuff anyways, this can be a great way to earn rewards. This card’s benefits are not good enough to justify buying stuff you wouldn’t have bought anyways, though, and the fact that the points can only be redeemed for Sony Rewards might turn some people off.

Overall, this is an exciting credit card opportunity that should be heavily scrutinized. Don’t just buy it because you have a PS4 lying around, because opening unnecessary credit cards can be a great way to put yourself on the road to crushing debt. For some people (like heavy Sony/PlayStation users), though, this can be a great credit card and should be further explored.

Learn more about the Sony PlayStation VISA credit card from Capital One